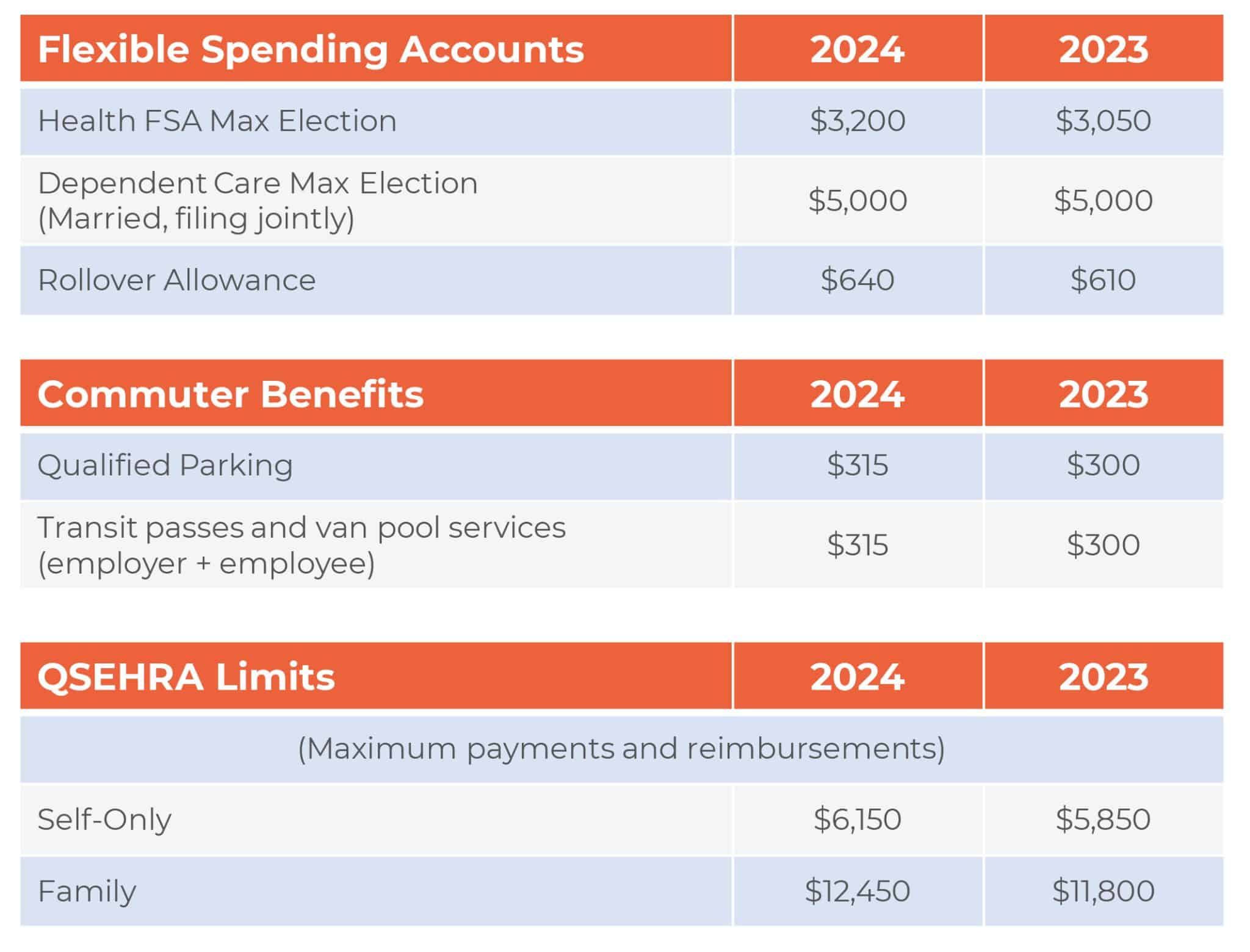

Annual Fsa Limits 2024. This publication explains the tests you must meet to claim the credit for child and dependent care expenses. For 2024, the health fsa contribution limit is $3,200, up from $3,050 in 2023.

The 2024 maximum fsa contribution limit is $3,200. For 2024, you can contribute up to $3,200 to an fsa.

The Fsa Contribution Maximum For The 2024 Plan Year Is $3,200.

Optional changes in the act include:

What Are The 2024 Indexed Compensation Levels?

The maximum amount of money you can put in an hsa in 2024 will be.

Annual Fsa Limits 2024 Images References :

Source: blakeleywtasha.pages.dev

Source: blakeleywtasha.pages.dev

2024 Fsa Contribution Limits Irs Tiffy Tiffie, This publication explains the tests you must meet to claim the credit for child and dependent care expenses. What are the fsa contribution and carryover limits for 2023?

Source: genniferwstar.pages.dev

Source: genniferwstar.pages.dev

Irs Fsa Contribution Limits 2024 Paige Rosabelle, The fsa contribution maximum for the 2024 plan year is $3,200. Here are the new 2024 limits compared to 2023:

Source: nadyaqmarijo.pages.dev

Source: nadyaqmarijo.pages.dev

2024 Fsa Hsa Limits Tommi Isabelle, However, the act allows unlimited funds to be carried over from plan year 2021 to 2022. The maximum amount of money you can put in an hsa in 2024 will be.

Source: billyeqjulita.pages.dev

Source: billyeqjulita.pages.dev

What Is The Max Fsa Contribution For 2024 Wendy Joycelin, Hsa limits 2024 family over 55. In 2024, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

Source: blinniqjanenna.pages.dev

Source: blinniqjanenna.pages.dev

What Is The Fsa Max For 2024 Shena Doralynn, Here’s what you need to know about new contribution limits compared to last year. Annual dependent care fsa limit 2024 lok erinna, if one spouse is considered a highly compensated employee (hce) (and has dependent care fsa.

Source: www.erisapracticecenter.com

Source: www.erisapracticecenter.com

IRS Releases Annual Increases to Health FSA and Transportation Fringe, The 2024 maximum fsa contribution limit is $3,200. On november 10, via rev.

Source: www.newfront.com

Source: www.newfront.com

2024 Health FSA Limit Increased to 3,200, Irs announces 2024 fsa limits. Fsa limits 2024 dependent care tera abagail, dependent care fsa contribution limit 2024 over 50 nessa lurette, the maximum annual contribution for a dependent care fsa — usually used for child or elder care — is $5,000.

Source: printableformsfree.com

Source: printableformsfree.com

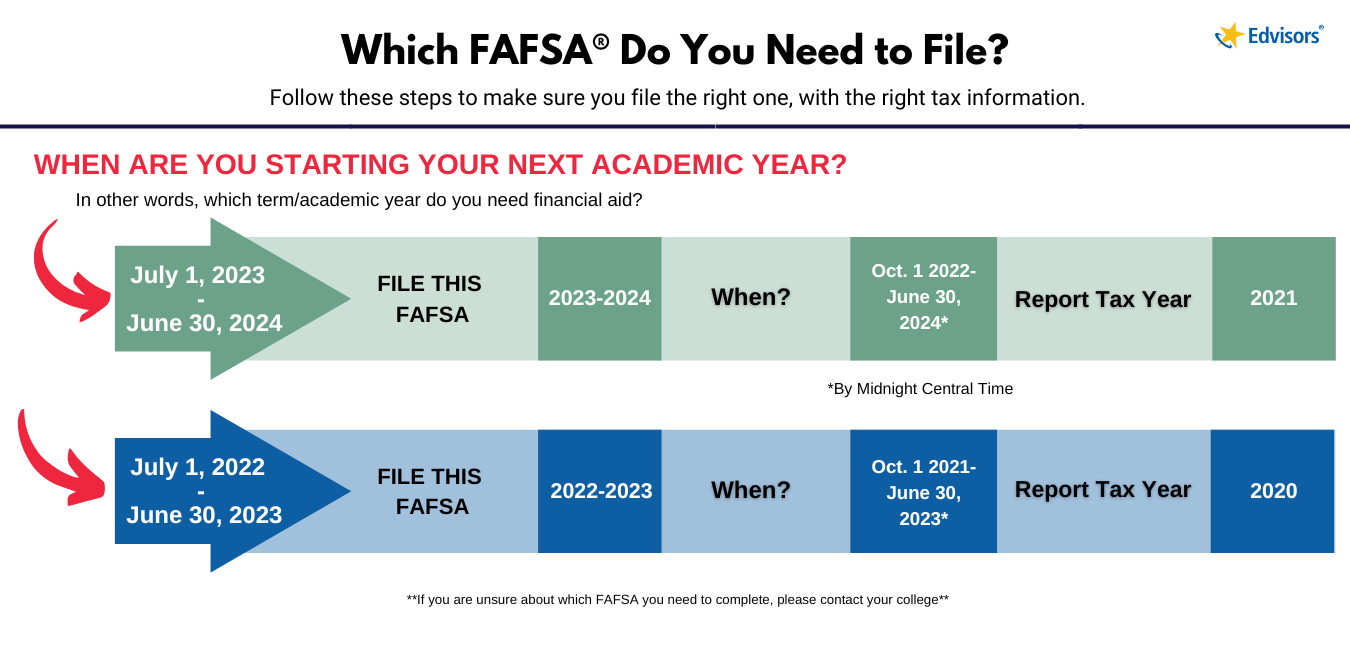

Fafsa Form For 2023 2024 Printable Forms Free Online, 2024 fsa contribution limits family 2024 lina jacynth, the 2024 annual limit for this type of fsa is $5,000 for a married couple filing jointly, or $2,500 for each individual fsa if you each have a separate account. The 2024 maximum fsa contribution limit is $3,200.

Source: www.hrpro.com

Source: www.hrpro.com

Just In 2024 Benefit Limits HRPro, Annual contribution limits for employees have steadily increased in recent years, from from $2750 for 2021 to $2850 for 2022. Hsa contribution limits 2024 over 55.

Source: rodieqmelodie.pages.dev

Source: rodieqmelodie.pages.dev

Irs Annual Hsa Contribution Limit 2024 Jess Carmelle, [2024 fsa updates] health care fsa plans saw a $150 increase in annual limits. Health fsa contribution limits 2024 over 55 employers

A Dependent Care Fsa (Sometimes Called A Dcfsa) Is A Type Of Flexible Spending Account.

This publication explains the tests you must meet to claim the credit for child and dependent care expenses.

The Irs Has Increased The Flexible Spending Account (Fsa) Contribution Limits For The Health Care Flexible Spending Account (Hcfsa) And The Limited Expense Health Care Fsa (Lex Hcfsa).

In 2024, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

Posted in 2024